Blue Carbon: What the rising tide of coastal conservation means for the voluntary carbon market

November 4, 2025 - Research

Blue carbon projects, such as protecting and restoring mangrove ecosystems, have high potential to absorb carbon and protect communities, but they represent less than 1 percent of credits issued on the voluntary carbon market. In this piece, we examine why blue carbon projects matter, where current projects are up and running, and the key risks and opportunities that will shape future efforts.

What is blue carbon and why does it matter?

Blue carbon refers to the organic carbon that is captured and stored by coastal ecosystems, particularly within mangrove forests, tidal marshes, and seagrass meadows. While these habitats cover less than 0.2 percent of the ocean surface, they sequester atmospheric carbon at rates up to 10 times higher than those of terrestrial forests.[1] In addition, these ecosystems are home to rich biodiversity, protect coasts from storms and erosion, and are a source of food and livelihoods for millions of coastal communities.

Yet despite their importance, coastal ecosystems are being degraded and destroyed at an alarming rate due to seaside development, pollution, and aquaculture. This decline highlights both the urgency and the opportunity for action. Blue carbon projects account for less than 1 percent of the total credits issued to date in the voluntary carbon market.

This post presents key aspects of blue carbon projects, including current methodologies, potential opportunities, existing challenges, and the present market status.

The methodology landscape

Early blue carbon projects relied on general forestry methodologies, such as “Afforestation and reforestation of degraded mangrove habitats (AR-AM0014)” under the UN Clean Development Mechanism. This approach, adapted for afforestation and reforestation in degraded mangrove areas, provided a starting point but lacked the specificity needed to capture the full complexity of coastal ecosystems. It did not fully account for tidal hydrology and the soil organic carbon dynamics specific to tidal wetlands.

Over time, the voluntary carbon market has shifted toward methodologies that better reflect the unique ecological and social dynamics of coastal systems. A wider snapshot of available methodologies across different standards is provided below:

Standard | Key Methodologies | Ecosystem Focus | Geographic Scope |

| Verra (VCS) | VM0033 – Tidal Wetlands & Seagrass Restoration, VM0024 – Coastal Wetland Creation, VM0007 (REDD+), VM0015 (Avoided Deforestation) | Mangroves, tidal marshes, seagrasses | Global |

| Plan Vivo | Coastal Blue Carbon Methodology | Mangroves, seagrasses, salt marshes | Global |

| Gold Standard | Sustainable Mangrove Management Methodology | Mangroves | Global |

| CDM* (UNFCCC) | AR-AM0014 – A/R of Degraded Mangroves, AR-AMS0003 – Small-scale A/R on Wetlands | Mangroves, wetlands | Global |

| American Carbon Registry (ACR) | The Restoration of California Deltaic and Coastal Wetlands Methodology, The Mississippi Deltaic Wetland Restoration Methodology | U.S. coastal wetlands | Mainly USA |

| Climate Action Reserve (CAR) | Mexican Forest Protocol v3.0 | Forest + some coastal wetlands | Mexico, USA |

| Australia ERF | Tidal Restoration of Blue Carbon Ecosystems Methods | Mangroves, tidal wetlands | Australia |

*CDM methodologies are often used and adopted by a range of carbon crediting program. For example, AR-AM0014 is used by Verra.

Opportunities and risks in blue carbon projects

Investing in and developing blue carbon projects presents a unique set of opportunities and challenges that distinguish them from other nature-based solutions.

Opportunities

High carbon sequestration potential. Mangrove forests sequester an average of 1,023 tonnes of carbon per hectare, up to 10 times more than terrestrial forests on average.[2] This significant carbon storage capacity stems from their unique ability to capture and embed organic carbon within anaerobic soils. In these conditions, decomposition rates are considerably slower than those observed in terrestrial ecosystems.[3]

Storage underground. Unlike terrestrial forests, where carbon is mainly stored in living biomass (trees and other plants), most blue carbon is stored in sediments. Carbon-rich soils contain up to 90 per cent of a mangrove's organic carbon stocks [4].

Co-benefits beyond carbon. Blue carbon projects provide essential co-benefits that are critical for both human and ecological well-being. The dense vegetation of mangrove forests and salt marshes acts as a natural breakwater and coastal defence, protecting communities from storm surges, tsunamis, and erosion. They also serve as nurseries for commercial fish species, supporting local livelihoods and food security. Additionally, they filter pollutants from water and provide vital habitats for a wide range of biodiversity, from birds to marine mammals. Healthy blue carbon ecosystems support local economies through sustainable fishing, aquaculture, and ecotourism.

Risks and challenges

Exposure to climate change. By their very nature, coastal ecosystems are at the forefront of climate change. Sea-level rise, coastal erosion, and an increase in the frequency and intensity of extreme weather events, such as cyclones, threaten mangroves, which potentially leads to the loss of project sites.

Technical challenges in measurement. Accurately measuring carbon stored deep in muddy, underwater soil is technically complex and expensive. It requires specialised scientific expertise and equipment, making Monitoring, Reporting, and Verification (MRV) far more challenging than simply measuring trees in a forest.

A concentrated market

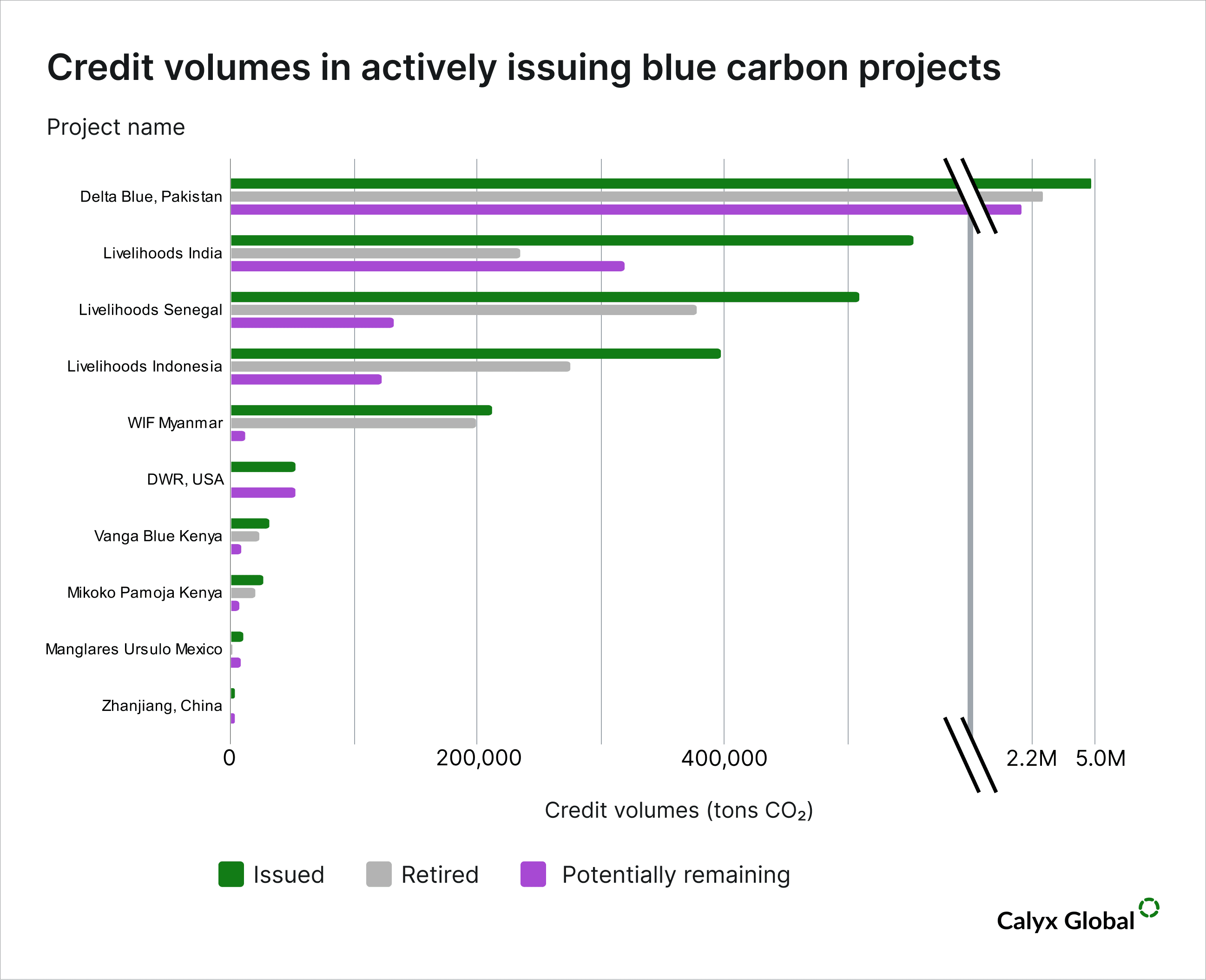

The blue carbon market is still in its early stages, but it shows significant potential for future growth. As of October 2025, there were 81 blue carbon projects worldwide, though only 10 were actively issuing credits on the voluntary carbon market. These projects collectively manage approximately 2 million hectares of coastal ecosystems and are committed to delivering an estimated 20.4 million tonnes of CO2 in removals annually.[5]

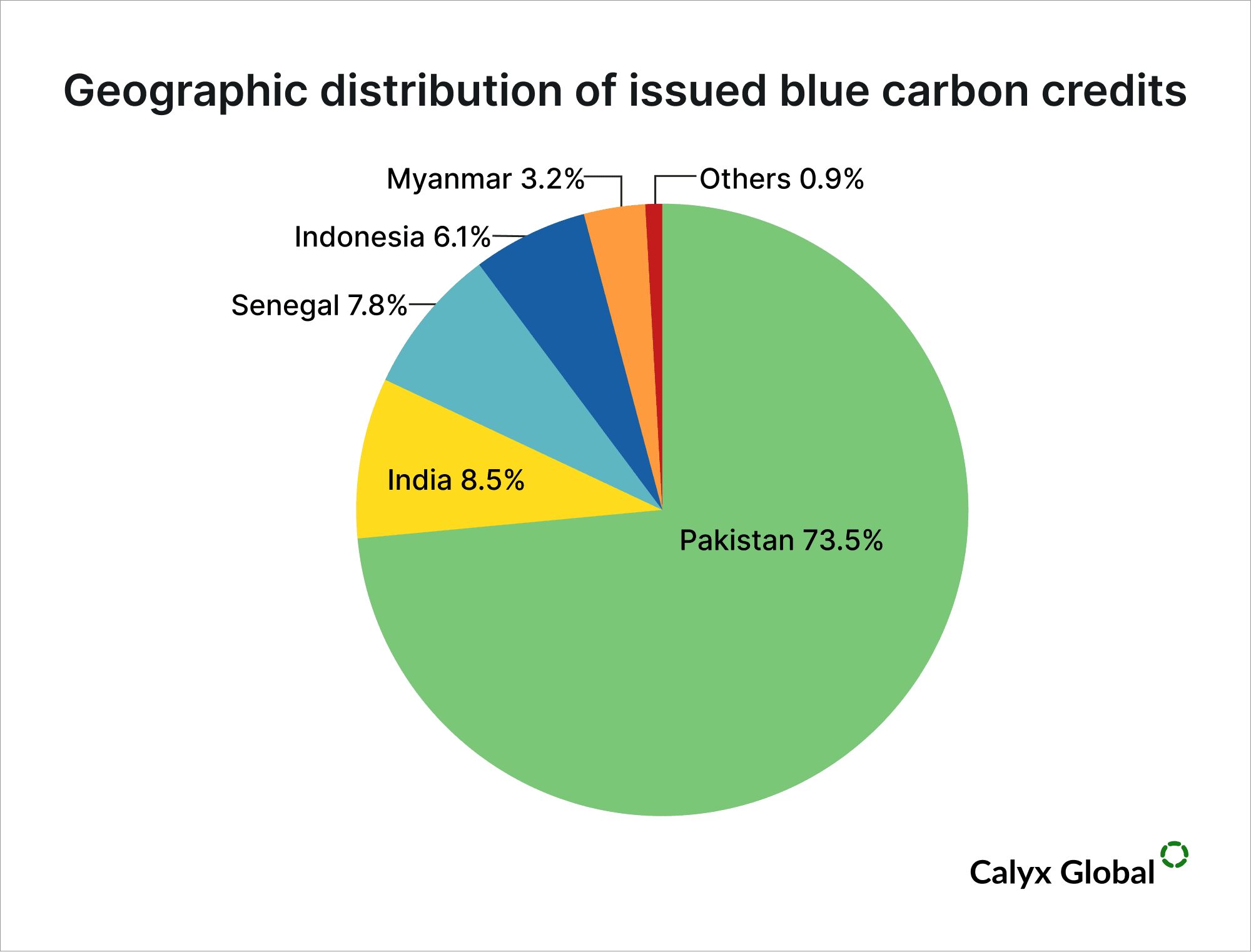

Geographically, projects are clustered in the tropical and subtropical regions of Asia and Africa, with host countries predominantly developing nations. Pakistan, India, Indonesia, and Myanmar are leaders in the number of issued credits.

Caption: Geographic distribution of the credit issued by country. Data derived from the Berkeley Carbon Registry Database (August 2025).[6]

In terms of ecosystem type, the market is overwhelmingly dominated by mangroves. These coastal forests account for an estimated 99 percent of all claimed removals from blue carbon projects and almost the entire project area under management.

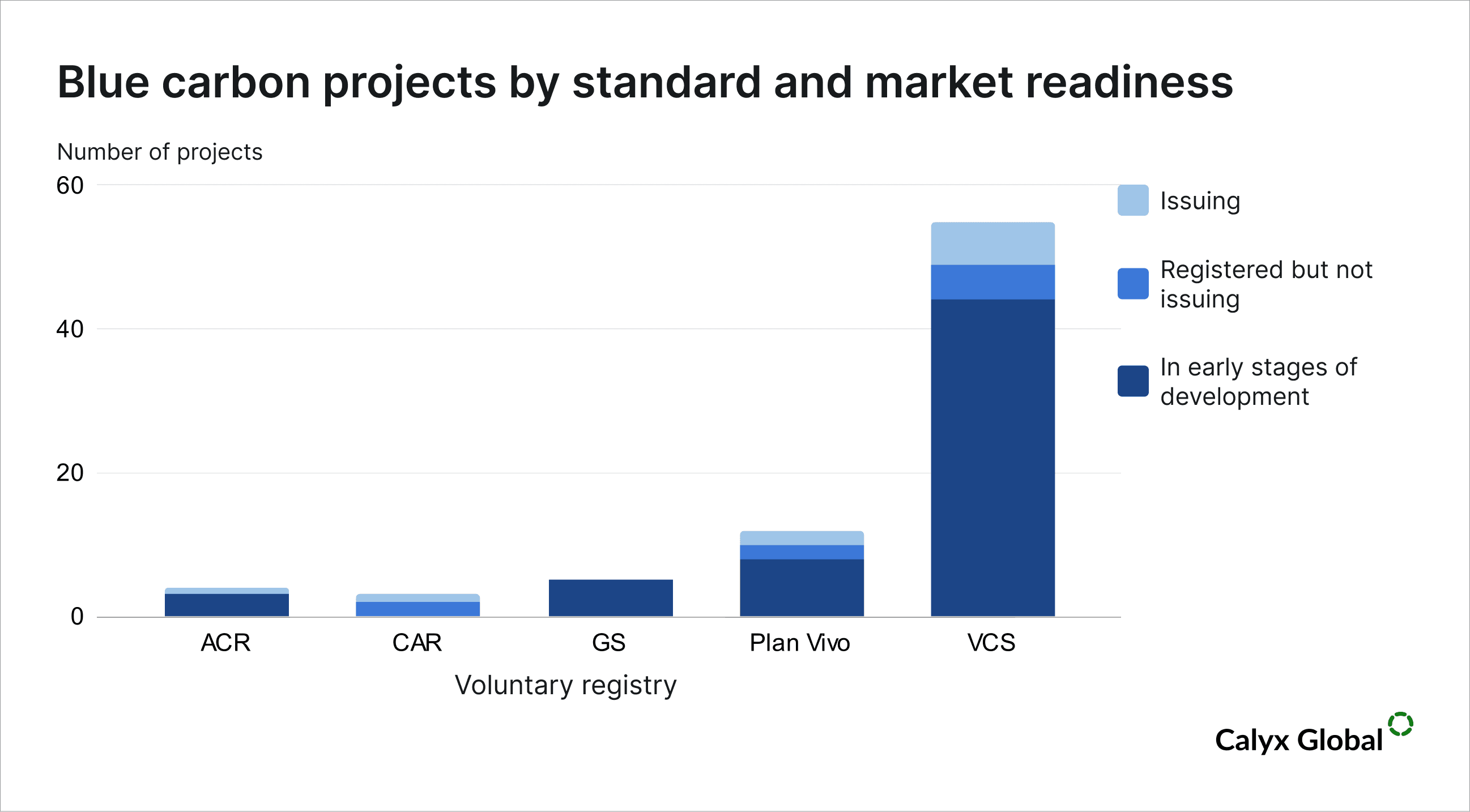

The market is also concentrated within a few carbon standards (see chart below). More than two-thirds of the projects are under the Verified Carbon Standard (VCS). Six of these projects are issuing credits, 44 are in some stage of development, and five are registered but not yet issuing credits. Plan Vivo is the second most common provider, with two projects issuing credits, two registered but not yet issuing credits and eight in various stages of development. Other registries, including ACR, Climate Action Reserve (CAR), and Gold Standard, have a total of 12 projects, of which only one ACR and one CAR project are currently issuing credits.

Caption: Number of blue carbon projects by standard and stage of market development. Project counts are broken down by their readiness for market across the standards (ACR, CAR, GS, VCS, Plan Vivo). Sources: The Berkeley Voluntary Registry Offsets Database as of August 2025 and Plan Vivo’s registry.

This concentration extends to the project level. A single project, the Delta Blue Carbon-1 project in Pakistan, covers 350,000 hectares and is responsible for an estimated 73 percent of all Blue Carbon credits issued to date.

Caption: Distribution of issued, retired, and remaining blue carbon credits among projects that are issuing credits as of October 2025.

Looking ahead, the pipeline shows the potential for rapid growth. Currently, many projects are under development or validation across multiple registries. Collectively, these projects represent an estimated potential of around 5.8 billion tCO₂ by 2075.[5] Once these projects are registered and start issuing, blue carbon could transition from a niche category to a significant share of nature-based solutions in the voluntary carbon market.

Citations:

1. Duarte, C. M., I. J. Losada, I. E. Hendriks, I. Mazarrasa, and N. Marbà. 2013. “The Role of Coastal Plant Communities for Climate Change Mitigation and Adaptation.” Nature Climate Change 3: 961–68

2. Donato, D. C., Kauffman, J. B., Murdiyarso, D., Kurnianto, S., Stidham, M., & Kanninen, M. (2011). Mangroves among the most carbon-rich forests in the tropics. Nature Geoscience, 4(5), 293–297. https://doi.org/10.1038/ngeo1123

3. Alongi, D. M., Murdiyarso, D., Fourqurean, J. W., Kauffman, J. B., Hutahaean, A., Crooks, S., Lovelock, C. E., Howard, J., Herr, D., Fortes, M. D., Pidgeon, E., & Wagey, T. (2015). Indonesia's blue carbon: a globally significant and vulnerable sink for seagrass and mangrove carbon. Wetlands Ecology and Management, 24(1), 3-13. https://doi.org/10.1007/s11273-015-9446-y

4. Cooray, P. L. I. G. M., K. A. S. Kodikara, M. P. Kumara, U. I. Jayasinghe, S. K. Madarasinghe, F. Dahdouh-Guebas, et al. 2021. “Climate and Intertidal Zonation Drive Variability in the Carbon Stocks of Sri Lankan Mangrove Forests.” Geoderma 389: 114929.

5. Farahmand, S., Hilmi, N., & Duarte, C. M. (2025). The rise and flows of blue carbon credits advance global climate and biodiversity goals. npj Ocean Sustainability, 4(39). https://doi.org/10.1038/s44183-025-00141-6

6. Haya, B. K., Bernard, T., Abayo, A., Rong, X., So, I. S., & Elias, M. (2025). Voluntary Registry Offsets Database v2025-06, Berkeley Carbon Trading Project, University of California, Berkeley.

Keep up with carbon market trends

Get the monthly newsletter and stay in the loop.

Trusted By