1,000 Calyx Ratings: What have we learned?

October 20, 2025 - News

Calyx Global has hit a new milestone – over 1,000 in-depth ratings, each generated by experts, not algorithms. We have been sharing lessons we learn along the way and will continue to do so.

Among carbon credit rating agencies, we have the largest, most reliable set of ratings covering the most project types. In this edition of our ‘What Have We Learned’ series, we provide a few tidbits on the new project types we are covering, with a focus on two categories we see quickly evolving: cookstoves and biochar.

#1 – Finding quality in the long tail of the market

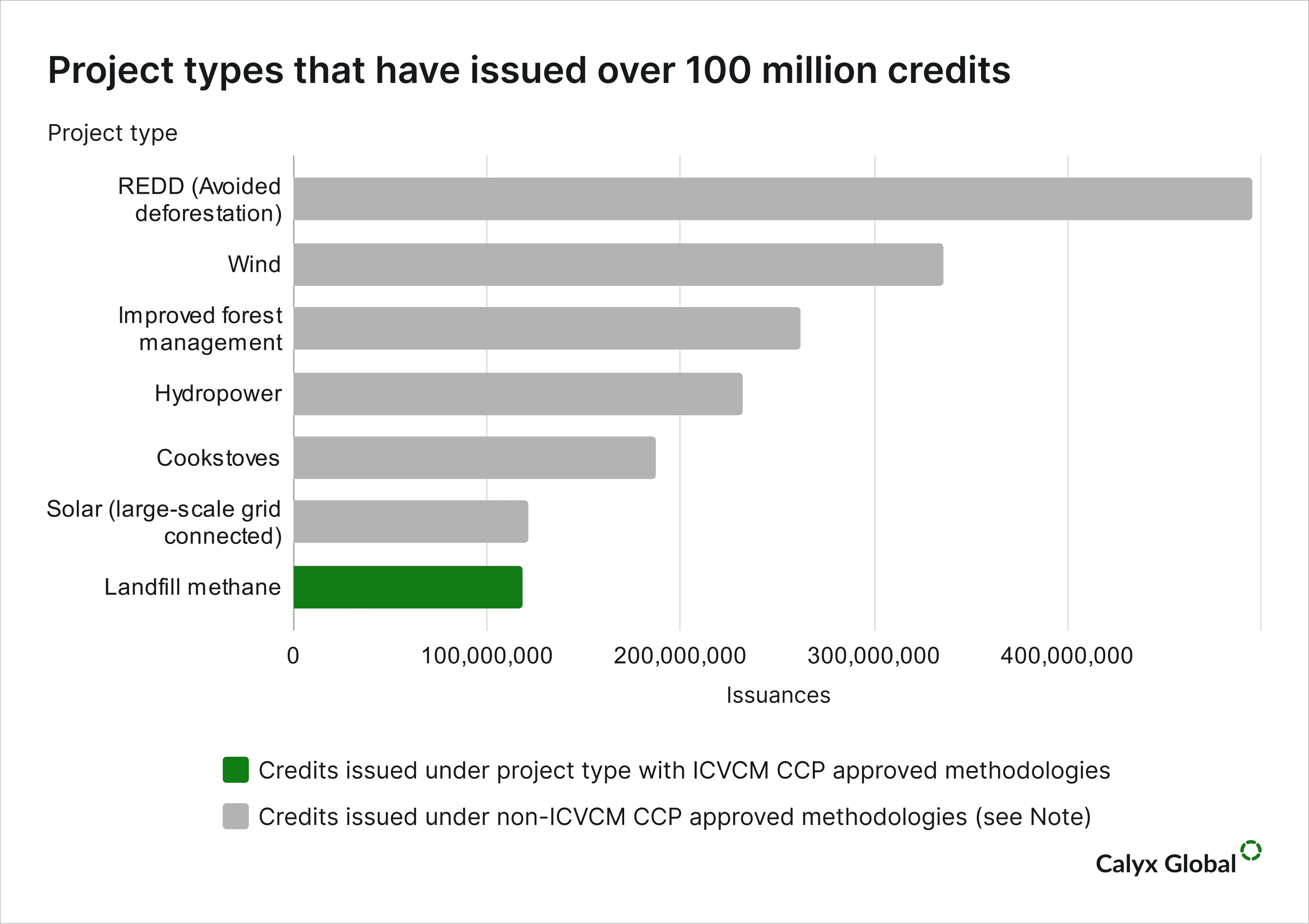

There is a concentration in the bottom three-quarters of the market. Like others in the ratings space, Calyx Global started by rating project types that comprise the majority of carbon credits issued: REDD, large-scale renewable energy (e.g., wind, hydropower, solar), improved forest management, cookstoves and landfill gas. Just seven project types comprise 74% of voluntary carbon market (VCM) issuances to date, but most have known quality issues – four of the seven have methodologies that received the Integrity Council for the Voluntary Carbon Market’s (ICVCM’s) Core Carbon Principles (CCP) label, but they are newer versions or have additional requirements. Most legacy credits for these four, along with credits from the remaining three project types have, so far, been rejected.

Source: Berkeley Carbon Trading Project

Note: Newer REDD and IFM methodologies were approved, but no credits have yet been issued under them; similarly, cookstove projects must meet a higher bar – and only a small number of credits will be issued in the near future.

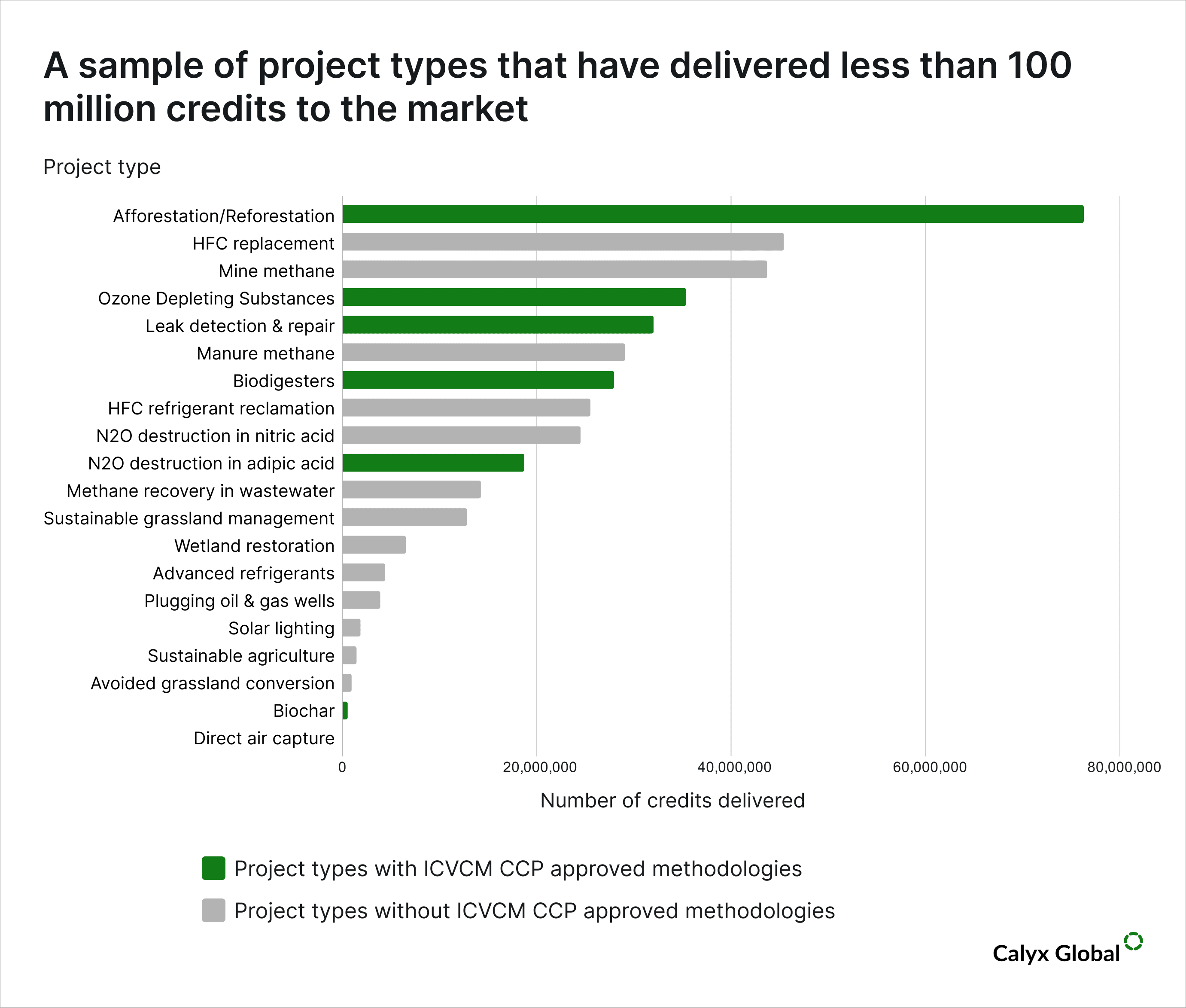

Diving into the long tail of carbon credits. The “other 26%” of credits are from project types that have produced fewer credits to date and often fly under the radar, but have the potential to issue higher integrity credits. At Calyx Global, we are continually expanding into new project types. We added eight new mitigation activities as we zoomed past 700, 800 and 900 to over 1,000 ratings. The market is dynamic, and there are many ways to mitigate greenhouse gas emissions.

The ‘known Calyx Global universe’ is constantly growing. We do a vast amount of research to bring new project types “in scope” for credit ratings. We develop a new framework for each new project type (consistent with our overarching ratings framework) before even beginning the rating process. Calyx Global covers a large array of project types, which now includes mine methane, artisanal biochar, low-CO2 concrete, subterranean bio-oil injection, leak detection and repair (LDAR), direct air capture (DAC), HFC replacement and more. These less prolific project types often produce high-quality credits, with several already having been assessed and approved by the ICVCM.

The “long-tail” of the market

Source: Berkeley Carbon Trading Project and Puro registry

Note: DAC and Biochar credits represented in the chart were exclusively issued using a Puro methodology, which is still under ICVCM assessment. Although the ICVCM has approved specific biochar and DAC methodologies, virtually no credits have been issued with the CCP label (one biochar project issued 3 tonnes, which are excluded from this representation).

We are learning as we explore new project types. Each project type brings its own constraints, incentives, issues and solutions. These differences give us opportunities to refine how we assess integrity, infusing fresh perspectives into our rating approaches, including improving our analysis for project types we’ve assessed for years.

Let’s explore a few of the new project types in the “long tail” that Calyx Global is now rating. Many tackle the superpollutants, such as methane, which are released collaterally from normal operations across various types of fossil fuel infrastructure:

- Leak detection and repair (LDAR) projects involve the systematic detection and repair of small methane leaks that occur across natural gas pipelines, transmission networks and other oil and gas infrastructure. These projects target emissions that would not normally be detected under existing maintenance operations.

- Orphan well plugging projects address emissions from legacy fossil fuel infrastructure, specifically oil and gas wells that have no known solvent owner and are currently leaking methane into the atmosphere. It can be difficult to accurately quantify the expected emission reductions from plugging these wells due to the uncertainty of geological fluctuations and the regulatory environment – but these projects have high potential to stop methane from leaking into the atmosphere.

- Coal mine methane (CMM) drainage projects can significantly reduce methane emissions from active underground mines. These projects can be high quality, but they can also exhibit risks of non-additionality if they generate significant electricity to the grid or if they are operated by state-owned entities, due to increased access to funding and support.

We have expanded our ratings of carbon dioxide removal projects. We have already rated several nature-based CDR activities (e.g., reforestation, soil carbon sequestration, blue carbon), and recently added several new engineered CDR project types:

- Artisanal biochar projects are designed to improve the livelihood of farmers in poorer communities while simultaneously delivering improved soil fertility and climate impact. Carbon credits from such projects tend to have low risks of non-additionality and non-permanence, but can risk over-crediting unless a project goes above and beyond the methodology.

- Concrete CO2 injection is sometimes sold as removal-based credits and, as such, fetches high prices. But their superpower is actually avoided emissions – due to the reduction in cement use. These projects can also risk over-crediting.

- Bio-oil projects interrupt the natural carbon cycle, removing carbon from residual biomass that would otherwise burn or decompose and diverting it to geological storage. These can be higher-quality removals, although they are not currently an efficient means of carbon storage and are therefore expensive to produce.

- Direct air capture projects remove CO2 directly from the air using mechanical and chemical means, concentrate it and store it underground. The carbon storage is largely free of reversal risk. However, the process is energy-intensive, and most methodologies do not adequately account for all emissions. As a result, projects may issue credits before they produce a net climate benefit.

#2 – Cookstove projects are moving towards higher quality

Despite a rocky few years in the cookstoves sector, where new credit issuances have dropped amid criticism of widespread over-crediting, we are beginning to see a sector-wide shift towards higher GHG integrity. Promising actions by crediting programs, governing entities and individual project developers could usher in a new era of higher-quality cookstove credits.

Calyx Global expects to see new cookstove credits with higher GHG integrity, following the release of methodologies with improved guardrails to protect against over-crediting. Key drivers of this include the ICVCM’s CCP labeling criteria, setting a new “minimum standard” for cookstoves. In addition, Verra’s VM0050 and the Clean Cooking Alliance’s CLEAR methodology, alongside standard-level adjustments, bring existing projects in line with the latest science. Furthermore, Gold Standard announced new rules for projects to determine their fNRB value – a critical parameter for determining emission reductions.

A key lesson we have learned after rating over 200 cookstove projects is that assessing GHG integrity requires a deep dive into the project-specific context and literature. A blanket approach does not work. Differences in the context of where a project is implemented (e.g., regional trends in cooking practices, government regulations, forest dynamics, etc.) and elements of an individual project’s design can yield a wide range of possible risks that often go undetected by a simplified benchmarking approach.

In our GHG integrity assessment of cookstove credits, we increasingly rely on project-specific literature, data and contextual information to identify these risks. Rather than relying on default benchmark values, we apply a thorough, project-specific analysis of key parameters such as the baseline fuel consumption value, wood-to-charcoal conversion factor and stove efficiency, to inform our quantitative assessment of a project’s claimed emission reductions.

We increasingly see more transparent documentation from project developers, with additional information for us to discern and distinguish between them. By grounding our assessments in project-specific context and continually updating our process as new evidence emerges, we ensure our ratings reflect the latest data and most relevant risks.

#3 – Biochar is evolving quickly

The biochar carbon credit market is nascent, moving from a learning to a consolidation phase. This is reflected in the rapid number of carbon programs developing their biochar methodology and the constant evolution of the Puro Biochar Methodology, which pioneered and holds most of the industrial biochar projects.

For example, Puro.earth’s General Rules and Biochar Methodology have evolved to address key biochar issues:

- Refinements in permanence factor calculations: Recent methodology versions have updated how biochar carbon removal is calculated, introducing more rigorous, data-driven models that better reflect actual biochar decomposition rate.

- Stronger MRV requirements: Updates have strengthened traceability, project emissions accounting and transparency, improving project accountability.

- Clarifications on additionality: There is increasing scrutiny on how additionality is demonstrated, moving beyond economic arguments to more nuanced assessments of barriers and market conditions.

We see that biochar projects are maturing in the VCM. Project developers have followed methodological changes by adopting more robust approaches to challenges such as accurately determining carbon stability factors, demonstrating additionality, and managing the variability and traceability of feedstocks, processes and end uses. The new methodologies and requirements have not deterred new projects from registering; on the contrary, we see an increasing number of projects listed in various carbon programs.

The result of this dynamic process is a diverse landscape, with some early projects using more simplified approaches, as previously allowed, and more recent projects applying more robust approaches. Site-specific data and traceability measures are helping to reduce risks and uncertainty. These shifts signal a trend toward higher integrity – but also a need to look at each project on a case-by-case basis.

Similar to what we are seeing with cookstove carbon projects, we expect that over time, the results of these methodological revisions will build greater trust in both project types.

See how we’re applying these learnings to ratings in the Calyx Global Platform. Sign up for free.

More from this series:

700 Calyx Ratings: What have we learned?

600 Calyx Ratings: What have we learned?

500 Calyx Ratings: What have we learned?

Keep up with carbon market trends

Get the monthly newsletter and stay in the loop.

Trusted By