What makes a high-quality carbon credit?

July 16, 2024 - Research

A high-quality carbon credit delivers on its claim of one tonne of CO2e reduced or removed and has safeguards in place to protect the people and environment within which it operates. Providing additional benefits, such as health or revenue to local communities and ecosystems also plays an important role. Some carbon credit buyers may consider this an essential element of quality, while others may not prioritize it.

To ensure quality—and increase the positive impact of carbon markets—buyers need to know what to look for when selecting projects and purchasing carbon credits. Below, we’ll discuss the current state of quality in the Voluntary Carbon Market (VCM), how carbon credit quality is defined and assessed, and what buyers can do to minimize their reputational or financial risk.

The size of the voluntary carbon market

Prior to 2019, there were fewer than 80 million voluntary credits issued in a given year. Since 2019, that figure has grown. Over 350 million voluntary carbon credits were issued in 2021, when VCM transactions peaked with a market value of $2 billion.1 By 2024 carbon credit transactions decreased to $535 million USD, according to Ecosystem Marketplace. While the average price of a carbon credit decreased in 2024 compared to 2023, the average transaction price of $6.37 is more than double that of 2020.

Why carbon credit quality matters

The VCM is, by definition, outside of regulations. Therefore, there is no governmental authority providing a benchmark of quality, or rules for eligibility. All the VCM has is the court of public opinion—it must build broad confidence to survive and scale. Furthermore, the stronger the climate, community and ecosystem impacts, the more the billions of dollars spent will truly help propel society toward a lower carbon future and a more just and equitable planet. Conversely, low-quality carbon credits can hinder progress toward global climate goals and, in some cases, harm communities and ecosystems.

The state of quality in the voluntary carbon market

The earliest methodologies for estimating emission reductions (or removals) from carbon projects were created decades ago, with the first project launched in the 1980s. While there have been many ups and downs since then, the voluntary carbon market (VCM) has only recently achieved a scale of significance (as noted above, peaking in 2021). At the same time, more organizations began using carbon credits to make climate-neutral claims or to offset annual emissions from their operations and supply chains.

Together, the growth of the voluntary market and the rise of offset claims brought attention to the quality of voluntary carbon credits and sparked new efforts to strengthen carbon projects. In 2024 and 2025, some carbon credit programs revised their standards, while new multi-stakeholder rule-setting organizations began issuing guidance on quality, including the Voluntary Carbon Markets Integrity Initiative (VCMI) and the Integrity Council for the Voluntary Carbon Market (ICVCM), among others. We begin to see early indications that this attention is leading to higher-quality carbon credits and the emergence of “VCM 2.0,” though there is still much room for improvement.

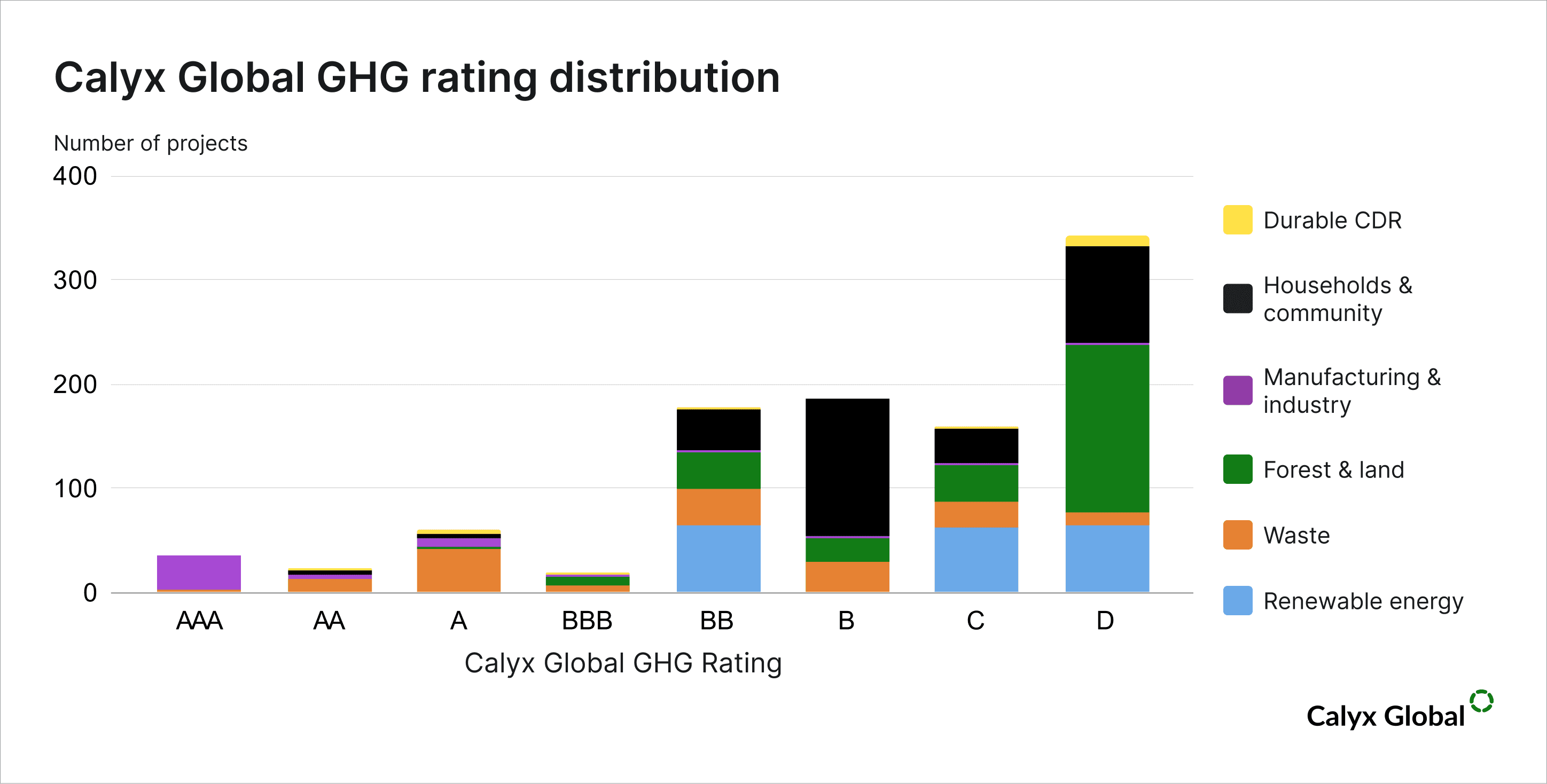

Calyx Global has over 1000 ratings on the quality of carbon project claims, representing over 50% of the credits issued in recent years. To date, we find only a small fraction receive the highest possible rating for greenhouse gas (GHG) integrity.

Our research shows that quality is a persistent challenge and that many carbon credit buyers still struggle to find credits that have a lasting, positive impact. Failure to perform the necessary due diligence before purchasing carbon credits can create substantial risk. Organizations have found themselves in headlines connected with projects accused of having little to no impact, poor implementation, or inadequate measurement and monitoring. As a result, they have faced scrutiny for supporting projects with unsubstantiated climate claims or, worse, projects associated with negative impacts on local communities or ecosystems. To make more informed investments, many organizations are now looking for more information on quality and impact before purchasing carbon credits. They may connect with project developers directly, utilize tools such as carbon credit ratings, or partner with carbon project experts to help find high-quality carbon credits and conduct due diligence for projects and proponents.

Increasing quality and price correlations in the VCM

Calyx Global tracks the quality of carbon credits issued and retired in the VCM as well as the quality-price correlation in the Calyx Carbon Indices. As of September 2025, the Calyx Carbon Integrity Index shows issuances at a value of 4.5 and retirements at a value of 3.5 and broadly trending upward. Both of these indices show increasing quality in the VCM beginning in Q3 2023. The Calyx-ClearBlue Carbon Price-Integrity Index shows an increasing quality-price correlation beginning in mid-2024. As of September 2025, the average premium of a Tier 1 credit compared to a Tier 3 credit is 47%.

Defining GHG quality in carbon credits

Four measures define the greenhouse gas integrity of a carbon project according to the Integrity Council for the Voluntary Carbon Markets Core Carbon Principles. While the ICVCM published these principles in 2023, the concepts of additionality, permanence and quantification are referenced in carbon project standards dating back several decades. They are:

Additionality: The greenhouse gas (GHG) emission reductions or removals from the mitigation activity shall be additional, i.e., they would not have occurred in the absence of the incentive created by carbon credit revenues. (You can read more about carbon credit additionality here.)

Permanence: The GHG emission reductions or removals from the mitigation activity shall be permanent, or, where there is a risk of reversal, measures shall be in place to address those risks and compensate for reversals.

Robust quantification of emission reductions and removals: The GHG emission reductions or removals from the mitigation activity shall be robustly quantified based on conservative approaches, completeness and scientific methods.

No double counting: The GHG emission reductions or removals from the mitigation activity shall not be double counted, i.e., they shall only be counted once towards achieving mitigation targets or goals. Double counting covers double issuance, double claiming, and double use.

For a carbon project to move through development, become operational and issue certified credits, it will typically apply for recognition within a carbon credit program and follow published rules for third-party verification. Over 95% of carbon credits are issued from projects developed with one of four carbon credit programs: Gold Standard, VCS, ACR and CAR. These programs have processes by which they establish standards, publish and update carbon project methodologies and measurement protocols, require independent validation of projects and verification of credits, and host public registries to track credit issuances and retirements. More recently, a number of new programs have arisen – such as puro.earth, Isometric, the Global Carbon Council, and more.

Why the quality of carbon credits varies

Methodologies as well as specific project implementation choices have the greatest impact on quality. A carbon project methodology is the set of instructions a project developer uses in their activity and is, by design, not prescriptive. This allows a single methodology to apply to various contexts, geographies and scenarios. This flexibility allows for unique situations a carbon project developer may encounter but also leaves room for less conservative choices or, in some cases, gaming the system. As a result, quality among projects varies significantly.

Essential to carbon credit quality is mitigating risks and providing the proof to back up project claims. For example, additionality is core to carbon credit quality, yet the demonstration of additionality varies, even between projects that use the same methodology. Projects that follow the Clean Development Mechanism’s (CDM’s) methodologies must demonstrate that they considered carbon revenue before they started and that the project is not common practice, is not legally required and is not financially attractive without carbon revenue, or faces barriers that carbon revenue alleviates. While one project may provide strong evidence of prior consideration of carbon revenue by showing documentation of financial decisions through the project development timeline, another project following the same methodology may provide weak or contradictory evidence, yet our analysis finds both can receive validation from a third party and approval from the carbon crediting program to issue credits.

How carbon credit quality is assessed

To rigorously assess carbon credit quality, carbon credit buyers may turn to carbon credit rating agencies, consult with external experts or build internal expert teams. In all cases, the core indicators of quality — additionality, permanence, quantification and double-counting — will likely be assessed. In each case, the evidence assessors seek and the level of detail they pursue to understand the project will vary. In the case of carbon credit rating agencies, assessments result in a carbon credit rating and should also include insight into the analysis behind the rating. These ratings and insights are then available on a subscription platform like the Calyx Global Platform.

While additionality, permanence, robust quantification and double-counting are the quality markers set by the ICVCM, how each factor is assessed can differ depending on who is doing the evaluation.

- Additionality: Most commonly, assessing the additionality of a carbon project involves understanding context and motives. Key tests for additionality include examining if the project introduces uncommon practices in the region, surpasses regulatory requirements and demonstrates prior consideration of carbon revenue, with financial impact serving as a crucial indicator of necessity for the project activity to take place.

- Non-permanence: According to the ICVCM and many others, carbon credits should represent long-term mitigation benefits. The length of time to be considered “long-term” varies depending on the assessor. At Calyx Global, we look for evidence of carbon credits’ durability, giving higher rewards to those that approach 100 years. By contrast, the ICVCM benchmark is currently 40 years. Some project types have little-to-no risk of carbon gains being undone or reversed, while others, such as nature-based projects, are more susceptible to both natural and man-made disturbances that can reverse the carbon gains. In higher-risk cases, evidence that reversal risks are covered by compensation mechanisms can potentially allow credits to be deemed higher quality.

- Robust quantification: Emission reductions and removals quantification are assessed by evaluating the “business-as-usual” baseline emissions, the emissions (or removals) in the project scenario, and whether leakage (when the mitigation activity causes emissions to move to another location) is appropriately accounted for. A robust baseline is best informed by experts in the project activity and the region. Ideally, a carbon project also implements a process to monitor and adjust baseline emissions as needed over time. This often goes above and beyond the requirements of a given standard or methodology and can significantly improve quality and reduce risk.

- Double-counting: Each carbon credit should represent one tonne of CO2e and should not be used to offset more than one tonne of CO2e. To prevent double-counting, each credit should only be registered in a single registry and should only be “retired” (for example, used as an offset) once. In some cases, carbon credits from a project may benefit government emission quotas (e.g., mandatory cap-and-trade regulations). Projects that could contribute to such regulations must take steps to avoid double-counting, to ensure the government is not also claiming the emission reductions in their GHG reporting.

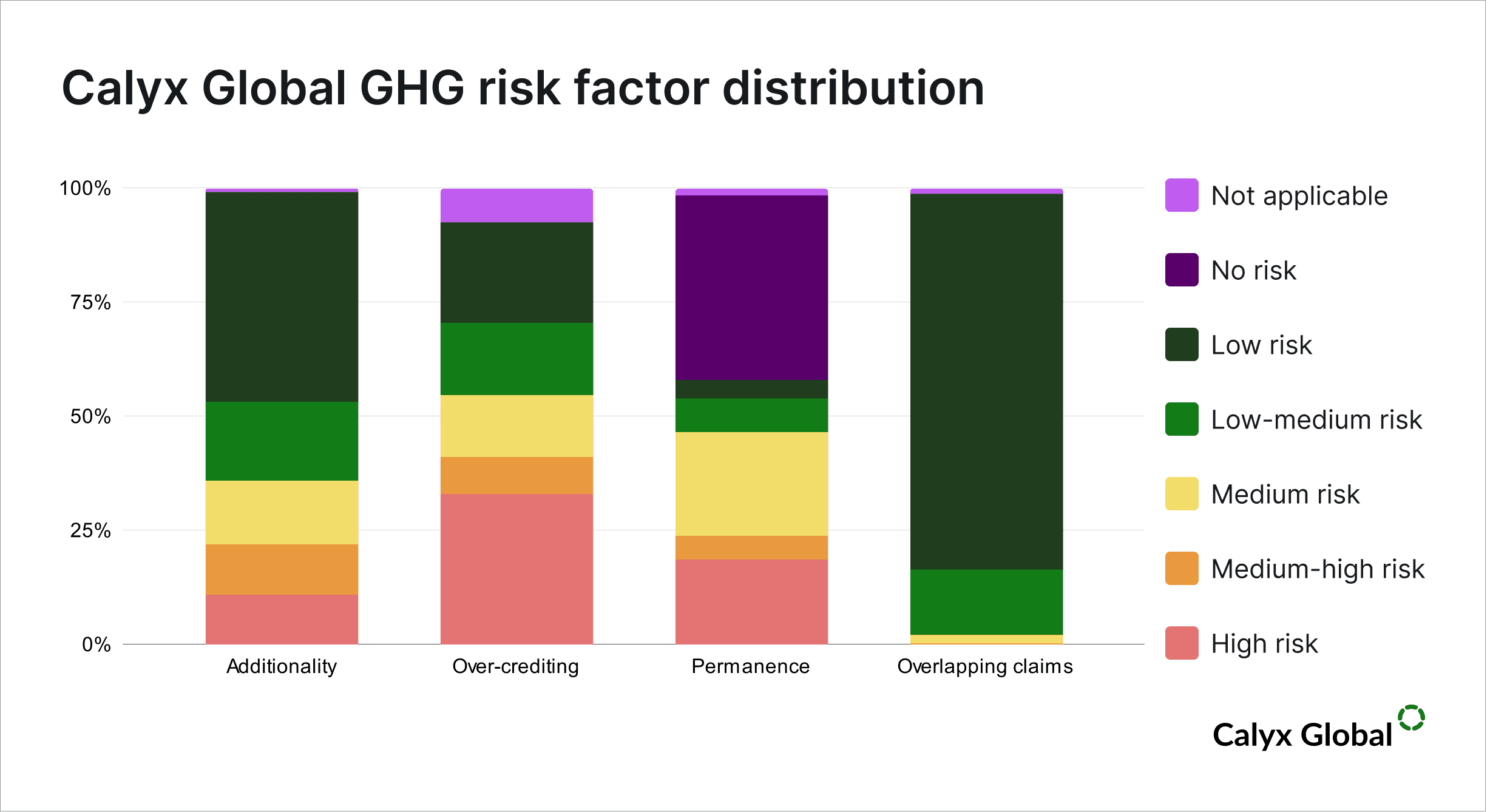

Fig. 2. Of the projects Calyx Global has rated to date for GHG integrity, almost 40% indicate a medium or higher risk of non-additionality and about 50% reach a medium or higher risk of non-permanence. Over 50% have similar risks for over-crediting. Many projects demonstrate multiple risks, which has led to the distribution of ratings illustrated in Fig. 1. Note that "not applicable" indicates projects for which a risk assessment was not conducted.

Carbon credits and the UN SDGs

The United Nations adopted the 17 Sustainable Development Goals (SDGs) in 2015 to help achieve a better and more sustainable future for all. Each of these SDGs represents a specific thematic area or global-level challenge to be addressed by the year 2030. The SDGs can serve as a guide for carbon project developers in designing interventions that support a wide range of objectives, from environmental sustainability and climate action to poverty reduction, job creation and economic growth.

SDG certification in carbon projects

A project developer can pursue certification of SDG impacts through initiatives such as Verra’s Climate, Community & Biodiversity (CCB) framework, Standards and Sustainable Development Verified Impact Standard (SD VISta), or Gold Standard for the Global Goals (GS4GG). Using SDGs as a means for structuring the implementation of benefits ‘beyond carbon’ offers a universally recognized framework for reporting both societal and environmental contributions. By buying carbon credits that measurably support these goals, carbon credit buyers can also advance some of their other sustainability commitments.

Fig. 3: The 17 SDGs pictured above serve as guidance for responsible development that improves communities and the planet.

What are safeguards, and why do they matter for high-quality carbon credits?

A critical component of quality is ensuring a carbon project does not harm the people and the environment where these projects happen. Environmental and social safeguards are policies, standards and operational procedures to identify, avoid and mitigate negative outcomes from a project. Important hallmarks of quality with respect to safeguards include meaningful, early participation of impacted communities, adequate benefit-sharing mechanisms, ongoing engagement, reporting and grievance mechanisms, comprehensive environmental impact assessments, and safety measures in project set-up and operations.

The state of safeguards in carbon projects

Although many carbon crediting programs incorporate environmental and social safeguards within their requirements, these provisions are generally not comprehensive enough to fully align with best-practice standards. As of October 2025, Calyx Global’s comparative analysis indicates that safeguard requirements vary significantly across major carbon crediting standards. Programs such as Plan Vivo and Gold Standard for the Global Goals (GS4GG) demonstrate relatively strong alignment with established best-practice frameworks, particularly in areas related to governance, such as stakeholder participation and benefit sharing. By contrast, others (e.g., CAR, ACR) address only selected safeguard areas, with notable gaps in domains such as community health and safety.

The benchmark for such practices, which underpins Calyx Global’s safeguards framework, draws on internationally recognized standards, including the IFC Performance Standards, the World Bank's Safeguard Policies, the Equator Principles, and the UNDP's Social and Environmental Standards.

How to increase the quality of carbon credits

Carbon crediting programs and project developers have an outsized ability to increase the quality of carbon credits. For their part, carbon crediting programs can, and in some cases have, raised their own performance standards based on feedback from the ICVCM and other multi-stakeholder groups. This can extend to the qualifications and requirements the carbon credit programs place on the validation and verification organizations they work with, as well as the internal resources they dedicate to reviewing each project submission.

Project developers can go above and beyond the minimum requirements of a given project methodology. There are examples of project developers being particularly conservative when estimating baseline emissions (the level of emissions estimated to occur in absence of the project) or project emissions (the emissions the project activity itself may cause). Our analyses across several different types of projects show that conservative estimates measurably improve carbon credit quality.

What carbon credit buyers can do to improve carbon credit quality

In recent years, additional market players beyond carbon crediting programs have emerged to help establish quality guidelines and elevate the “demand side” quality in the carbon market. These include the VCMI, the Science-based Targets Initiative (SBTi) and Oxford University (with its “Oxford Offsetting Principles”), all of which guide and complement the in-house due diligence many carbon credit buyers are undertaking.

As the final investors in these projects, buyers of carbon credits have the power to fast-track VCM 2.0. Like any market, the carbon market is driven by demand. The more clearly carbon credit buyers demand high-quality carbon credits, the greater the signal sent to the market to produce those credits to meet that quality. Ensuring this happens will require due diligence, and buyers will need trustworthy tools that allow them to evaluate the claims behind any carbon credit. To read more about how Calyx Global assesses the quality of carbon credits and makes that information available on its platform, read Calyx Global Ratings Explained.

Citations

1Carbon Containment Lab. Types of carbon credits are traded in either a compliance market or in the voluntary market (or sometimes both). While the compliance markets are managed by a government authority, the voluntary market lacks regulatory oversight.

2The ICVCM Core Carbon Principles Assessment Framework, accessed at https://icvcm.org/assessment-framework/

3Carbon credits from ACR, CAR, Gold Standard and VCS programs currently make up 98% of the market, according to the ICVCM.

Keep up with carbon market trends

Get the monthly newsletter and stay in the loop.

Trusted By

About the author

Calyx Global Research Team