6 steps to sourcing high-quality carbon credits

November 11, 2024 - Commentary

Interested in more content like this? Join Autodesk, Calyx Global, ClearBlue Markets and Dimensional Fund Advisors as they share more on “How to buy high-quality carbon credits” on Wednesday, Nov 6, 2024.

Everyone active in the voluntary carbon market (VCM) has experienced the difficulty of discerning and sourcing quality among carbon credits. For organizations participating in the VCM to reliably ensure quality — and increase their positive impact and avoid reputational risk — it is about knowing what to look for when selecting projects and purchasing carbon credits. It is also about efficiently finding credits that meet those requirements.

To help companies find a carbon credit sourcing strategy that meets their needs, this post covers:

- The steps your organization can take to source high-quality carbon credits

- Defining carbon credit quality for your organization

- Identifying sources of high-quality carbon credits and pros and cons of each

Steps to sourcing high-quality carbon credits

Step 1: Calculate emissions

The first step is a clear picture of your organization’s emissions and a plan to reduce those emissions. To calculate your emissions, greenhouse gas accounting methodologies like the GHG Protocol will help identify all relevant emission sources (covering scope 1, 2 and 3 emissions) and set the stage for ongoing emissions tracking.

Step 2: Set your climate target and develop a plan

Organizations like the Science Based Targets Initiative can provide helpful guidance and benchmarks when setting an emissions reduction plan. Current guidance suggests aiming to reduce emissions by half by 2030 and, more ambitiously, by 90% by 2050. To understand which emissions to reduce and how, your organization can turn to the resources provided by climate action networks such as the SME Climate Hub, as well as for support on how to work with suppliers to measure their emissions and set reduction goals.

Step 3: Reduce your emissions

After establishing a reduction plan, your organization can identify whether carbon credits may play a role, and what that role is. Some organizations may elect to purchase carbon credits that cover all of their emissions annually. Others may choose to cover scope 1 and 2 emissions, or instead, to allocate a certain amount of money to credits from a project or projects of their choice.

At this stage, your organization will also determine whether or not to make a public commitment that requires the purchase of carbon credits. This will be important, later, when it comes to identifying high-quality carbon credits as it will dictate whether your organization will be compelled to purchase credits within a certain timeframe.

In concert with defining the role carbon credits will play, your organization will have to work within a budget. The budget should encompass the emission reduction plan and, if that plan is complemented by carbon credits, the purchase of credits as well.

Step 4: Define carbon credit quality for your organization

The quality of carbon credits varies in important ways across project types and carbon protocols. Now that your organization has a plan and a budget for carbon credits, defining the quality standards those credits must meet is the next step. (Though, as mentioned, defining quality may also feed iteratively into budgeting.)

On some aspects of quality, there is little disagreement. When a carbon credit is being used to offset greenhouse gas emissions, two characteristics are important to highlight. First, that credit must represent the one tonne of CO2e that it claims. Second, that carbon credit must come from an activity that was not already going to occur as a matter of course. That is, it must be additional.

According to the Integrity Council for the Voluntary Carbon Markets (ICVCM) Core Carbon Principles, there are four measures that define the greenhouse gas integrity of a carbon credit. They are 1) additionality, 2) permanence, 3) robust quantification, and 4) no double counting. Calyx Global also evaluates these same metrics to assess GHG integrity risk in our ratings. For more on how Calyx Global defines quality, see “What Makes a High-quality Carbon Credit?”

Step 5: Identify additional carbon credit attributes

Beyond the core aspects of quality, each carbon project carries its own potential benefits beyond carbon, as well as risks. Consider whether your organization has other goals or values to which your carbon credit purchase should contribute. Carbon projects in regions of the world where your organization sources from, or that provide benefits that align with initiatives for health, economic empowerment or conservation are all examples of potential overlap. At this point, it is helpful to reach out to peers and establish a network of trusted voices. So many organizations have established their own quality requirements and purchasing preferences and it will be valuable to tap into that experience and insight as your organization does the same.

Step 6: Identify a carbon credit provider

Next, your organization will want to consider who, or how, it will identify carbon credits and evaluate options against quality requirements and preferences.

With quality and purchasing preferences in hand, it is time to source carbon credits. Just as you reached out to peers for their emission reduction and carbon credit experience, reach out to those with project development and carbon market experience, to expand your network and knowledge of how carbon credits are developed, bought and sold.

Carbon credit purchasers have myriad options for sourcing, from investing directly in a developing project, to purchasing carbon credits from a broker or retailer, to purchasing from an exchange. While carbon credit sellers fall largely into a few categories, in reality, each of these entities can offer purchasers an array of services.

We share a high-level overview here while recommending purchasers spend the time getting to know their potential partners, learning what they offer and their relative strengths. We also suggest buyers consider combining multiple tools to get the best out of various service providers.

Buying carbon credits from project developers

Project developers may sell credits from their projects and, in some instances, may offer opportunities for purchasers to invest in carbon projects still in development.

Investing in carbon projects during development. Some project developers may work with purchasers on agreements that help fund carbon projects before credits are issued.

- Pros:

- Investing early in a carbon project may offer a company a long-term source of credits at a predictable price.

- It also offers the opportunity to bolster project quality, shaping the choice of methodology used, approach to monitor, delivery of co-benefits and other aspects.

- Being involved at this stage may also afford early insight into the project’s strengths and weaknesses, as well as the potential for more connection with project partners.

- Cons:

- Investing in a project will incur risks – in particular, that the credit will actually be delivered (often called “delivery risk”).

- Assessing early-stage projects can also be costly and requires deep expertise in the mitigation activity, carbon accounting methodology, commercial structuring and safeguards (to avoid environmental and social risks). Because both buyers and developers in this case will be very close to the project, and naturally, developers are advocates for the projects they are developing, it can be useful to add some level of independent due diligence to the process.

Purchasing carbon credits from operating projects. Some, though not all, project developers sell credits from their existing operating projects. In other instances, the developer may have pre-sold credits, as above, or may work with another entity that markets the credits.

- Pros:

- If the credits are already verified, the due diligence required is considerably lower than investing in projects that have not yet generated credits. This is because verified credits will have a minimum set of structured information submitted to the registry and will have been audited by an independent third party.

- In addition to checking the quality of the claims (including GHG integrity, SDG contributions and environmental and social risk management). Furthermore, unlike investing (as above), there is no “delivery risk” when purchasing credits that have already been verified (called a “spot” purchase).

- Because your purchase is directly with the developer, it can be the case that more of your purchase dollars reach those involved in the project. The project developer should be open to sharing this type of information, and buyers should ask about the impact of their purchase on the project. Sourcing from developers may also provide the option to customize deal structures, whether a one-time purchase or a longer-term contract to purchase credits as they are issued.

- Cons:

- Finding high-quality spot purchases in large volumes can be difficult in today’s market, although it is our view that they are available.

- If a buyer decides to purchase credits not yet generated or verified (called a “forward off-take”), there will be delivery risk and, as with investing during development, due diligence is almost entirely on the purchasers. It can be helpful to research the project developer, asking about their track record and contingency planning. The diligence can be done by tapping into experts within your organization or externally.

Buying credits from brokers or retailers

Both brokers and retailers sell carbon credits from active, operating projects in addition to offering other supporting services.

Purchasing carbon credits from brokers. Brokers serve as intermediaries between developers and buyers, often providing additional advisory services. They facilitate transactions for buyers and help to structure contracts that project developers may not have the ability to manage.

- Pros:

- Brokers provide access to credits from multiple projects across project types, geographies and prices, which is helpful for an organization looking to gain a big-picture understanding of what is available in the market, or aiming to build a diversified portfolio.

- Brokers may also offer supporting services such as carbon footprint calculations and management, among others.

- Cons:

- To cover their services of finding and presenting credit options, brokers add a fee to the carbon credit price.

- When sellers hold inventory or partnerships with specific projects, they are also conflicted when providing information about credits – as they receive a commission on the sale of the credits they sell. In other words, they may be incentivized to “sell the house wine.” Some brokers utilize carbon credit ratings to inform their teams and/or offer to their customers this independent view on the quality of credits they are selling.

Buying carbon credits from marketplaces

A buyer can also purchase credits from a marketplace. These are online sellers of carbon credits. Examples include Patch, Cool Effect, Atmosfair and many others.

- Pros:

- Marketplaces offer fast transactions and price transparency.

- They may also have a lower cost per credit in comparison with brokers or retailers.

- Cons:

- A buyer will need to accept the online seller’s terms and conditions for purchase.

- Unless the marketplace has independent ratings or other additional information on the quality of the credits, the task of conducting due diligence falls to the purchaser.

Buying carbon credits via an RfP process

Purchasers of credits can put forward a Request for Proposal (RfP) and invite sellers to present carbon credit options that align with specific quality requirements, purchasing preferences and price points. In fact, with a request for proposals process, the purchaser may ultimately purchase credits from the project developer, retailer or broker that is selected.

- Pros:

- This method gives large-scale buyers the ability to see a range of carbon credits that meet their specific climate and sustainability goals. Depending on the sellers that respond to the request, an RfP can provide a comprehensive market overview. Some organizations may require using an RfP process to procure carbon credits (e.g. public institutions).

- Cons:

- Issuing an RfP may not suit smaller organizations, as it can be a time and resource-intensive process. Depending on the scale and scope, in-house expertise or outside consultants may be necessary to assess the quality of the carbon credits offered and information presented by respondents.

A summary of the options for purchasing credits is provided in the table below.

| Pros | Cons | |

|---|---|---|

| Buy from developers | • Funding directly to activity | • Not all sell directly to buyer • Due diligence falls to purchaser |

Buy from resellers | • Can structure portfolio with one party • Offers other useful services | • Paid on commission, creating conflict • Buyer should do own diligence |

| Buy from marketplace | • Fast transaction • Easy price comparison | • Due diligence falls to purchaser • Must accept terms and conditions of the seller |

Run an RfP | • Can request characteristics desired • Receive numerous offers | • Considerable effort, long process • Due diligence falls to purchaser |

Invest in developer | • Can control quality, future credit stream • Impact to scale technology | • Need deep expertise for due diligence • Large volume commitment + delivery risk |

The mechanics of buying a carbon credit

Availability, delivery and retirement are also important considerations when purchasing carbon credits. It can be the case that an organization conducts its due diligence process and secures its budget only to discover the credits it anticipated are no longer available in the amount or at the price desired. Working closely with your sourcing partner, and being clear upfront about your decision timeline, will help mitigate this challenge.

It is also important to ask your sourcing partner about credit delivery early in the process. Your organization will want to plan for having carbon credits transferred into an account your organization owns, or for having the seller hold and retire credits on your behalf.

Make due diligence part of your purchase process

From setting your quality requirements to setting your budget, due diligence is an essential part of purchasing high-quality carbon credits. Protections can come from various sources, including consultants, brokers, in-house experts or rating agencies like Calyx Global. Whether investing in a project before development or purchasing carbon credits on the carbon market, independence and project-specific expertise will provide the most rigorous analysis.

Such scrutiny adds credibility and assurance by verifying factors that are often not part of validation or verification requirements. For example, minimizing the environmental or social risks (ESR) of a project, or ensuring the credits are additional and represent one tonne of CO2 reduced.

When investing in a carbon project during the development stage, the best due diligence will likely come from independent research and the use of advisors to inform and steer project quality.

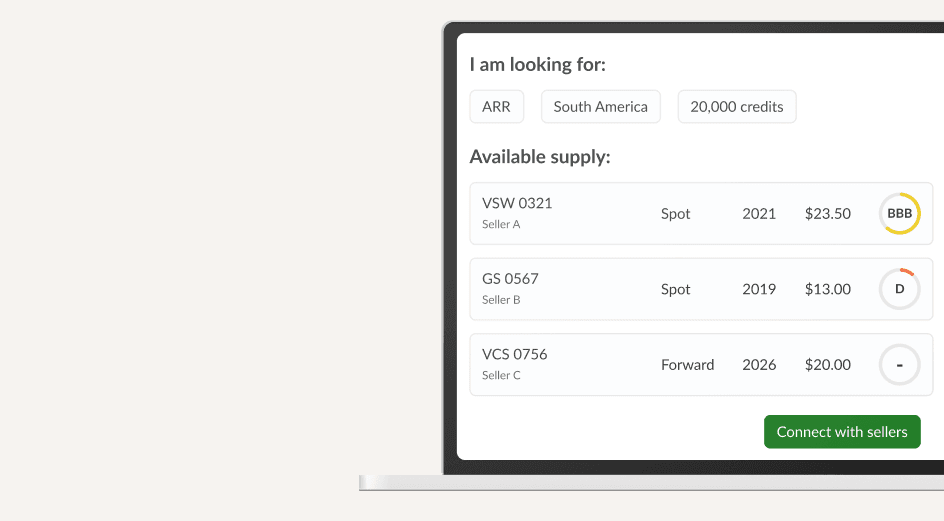

For small buyers: If you’re purchasing carbon credits after issuance, carbon credit ratings agencies can be a good place to start when searching for credits that meet your quality criteria. With a subscription, you can search for the quality criteria that matter to you from a GHG, SDG and ESR perspective. This can significantly shorten the time and resources required to purchase high-quality credits, particularly with small sustainability teams.

For brokers: Carbon credit ratings can provide buyers extra assurance of an independent review. Ratings agencies can also help assess the overall quality and risk exposure of the custom portfolios brokers build for clients.

For marketplaces: Carbon credit ratings can help buyers assess quality and provide an extra layer of unbiased evaluation to credits traded on sellers’ platforms.

For organizations issuing RfPs: Carbon credit ratings can streamline the evaluation of carbon credit offers. Ratings can also be used as a standard quality benchmark when issuing RFPs, which is especially important when fielding proposals from multiple applicants. Purchasers can prioritize projects that meet specific criteria, ensuring alignment with their sustainability goals and reducing evaluation time.

What is the right sourcing strategy for your carbon credit purchase?

Ultimately, your approach to sourcing high-quality carbon credits will be shaped by a variety of factors: how you define carbon credit quality, the type of expertise within your sustainability organization, the resources you have available and the goals you have established (for instance, whether you are seeking to purchase credits annually, etc.). There is no “one size fits all” approach.

We recommend taking time to build a network of peers and experts that will share their insights. Then do your research and find partners to help fill gaps that are not available within your organization. And be open to adjust as you gain experience, knowing that no one gets it right the first time around.

It is also helpful to recognize that your quality requirements may at times conflict with the timing of your purchase (are credits available when you need them) and your budget. Set expectations internally and share your expectations when speaking with the sellers you are considering as partners. This will help them be best positioned to support you.

To ensure you have full visibility into the quality of carbon credits, regardless of the sourcing approach you take, ensure independent due diligence is built into your process. Consider working with rating agencies like Calyx Global to be that independent voice or to help fill any gaps in your own quality assessments.

To learn more, join the webinar “How to buy high-quality carbon credits” or watch on-demand.

Keep up with carbon market trends

Get the monthly newsletter and stay in the loop.

Trusted By

About the author

Calyx Global Research Team

Next Up