Understanding carbon project methodologies: A guide to setting smarter investment criteria

July 28, 2025 - Research

In the quest for carbon credit quality, many investors and developers focus first on selecting the “right” methodology. It makes intuitive sense: a stringent methodology should produce higher-quality credits.

There’s some truth to that. Methodologies do shape project integrity, but only up to a point. The reality is that even a robust methodology can result in low-quality credits if its flexibilities are exploited. Conversely, a less stringent methodology can still lead to credible outcomes if the project goes above and beyond what is required.

Ultimately, in most cases, methodology application matters more than methodology selection.

Investors looking to de-risk their portfolios need to know what methodology a project uses, but also how that methodology was implemented. You must understand whether the choices made reflect a conservative, high-integrity approach – or one that pushes the limits, sacrificing quality.

Why application trumps selection

Carbon project methodologies are designed to be broadly applicable. That flexibility is intentional. It allows the same set of rules to be used across different geographies, scales and project types. For example, a methodology for afforestation, reforestation and revegetation (ARR) may need to work in both Brazil and Bangladesh, across varied ecosystems, data availability and implementation contexts.

That same flexibility creates room for divergent outcomes. Developers make critical choices when implementing a methodology: which data sources to use, how to set baselines and what assumptions to make about additionality, leakage or permanence. These decisions ultimately shape the integrity of the credits. The methodology merely sets a floor – the minimum required. Developers can choose to meet the minimum bar or to be more conservative in their emission reduction (or removal) claim.

Before the rise of carbon credit ratings and increased scrutiny of carbon projects, there were few incentives anywhere in the value chain to encourage conservative choices. If a project could credibly justify its choices within the flexible boundaries of the methodology, there was no push to go further.

Project developers often apply methodologies in ways that maximize credit volume – not as a way of cutting corners, but because the system rewards it. Most certification bodies are compensated based on the number of credits produced. Brokers earn commission based on sales volume. Even buyers, under pressure to hit climate targets affordably, may have historically shied away from tough questions about how credits were generated.

That’s beginning to change. As independent ratings and market scrutiny grow, so too does the incentive to make conservative and scientifically robust choices. Buyers and investors are paying closer attention to how carbon project methodologies are actually used. Without scrutinizing application, investors risk overestimating quality and exposing themselves to reputational and financial risk.

You can’t assess what you don’t understand

So, how do you meaningfully evaluate a project’s application of a methodology?

You must first understand the methodology itself. Investors can’t evaluate application without knowing what choices are allowed in the first place, or where those choices carry the most weight.

Every methodology includes areas of discretion. These gaps and flexibilities are not necessarily flaws. They exist to allow the methodology to work across a wide range of real-world conditions. They are also the areas where developer decisions can have the greatest impact on credit quality.

For example, one methodology might offer broad latitude in setting baseline emissions, while another may allow developers to choose from a range of monitoring parameters or default values. Projects that select conservative inputs, erring on the side of under-crediting rather than over-crediting, are more likely to produce high-integrity outcomes. Identifying those moments of discretion requires a clear understanding of the methodology’s design.

This is where many investors struggle. Without knowing where the levers are, it’s difficult to ask the right questions or spot the red flags. As a result, application risks often go unnoticed, and an investor may find that, once the credits are ready to be issued and sold, – the value of the credits is lower than expected due to their poor quality.

You can’t effectively evaluate how a methodology was applied if you don’t understand where its risks and flexibilities lie.

Methodology risk examplesEarly REDD methodologies (VM0006, VM0007, VM0015) allowed project developers to develop their own baseline deforestation risk maps. This proved problematic, often resulting in a high risk of over-crediting. The market has learned and the standards have responded: baseline setting under the new REDD methodology, VM0048, uses a prescribed baseline, developed by an independent third party. IFM methodologies also have flexibility that can result in over-crediting risk. For instance, under the VM0010 methodology, project developers can choose between a Historical Baseline Scenario and a Common Practice Baseline Scenario. Project developers have the option to choose either approach, which may lead them to select the one that is most favorable(i.e. higher baseline emissions), potentially increasing the risk of over-crediting. Proving Additionality: Many methodologies under all the major standards allow project developers to present either a barrier test or an investment test to demonstrate additionality. A barrier analysis is not adequate to clearly show that carbon finance was critical for project implementation – they key question for determining whether a project is additional. |

Identifying the areas of a methodology that allow for discretion is central to Calyx Global’s rating process:

- Where do methodologies have gaps and flexibilities?

- How were these choices navigated by the developer?

- Did they take a conservative and scientifically robust approach?

- Did they provide transparency and justification?

These are the decisions that ultimately shape credit quality.

Unpacking the layers of methodology complexity

Understanding the methodology landscape is important. It’s also incredibly challenging.

Calyx Global has analyzed more than 75 methodologies across dozens of project types. Some categories use many methodologies, such as ARR, where we’ve assessed methodologies. Others may only have one or two in use.

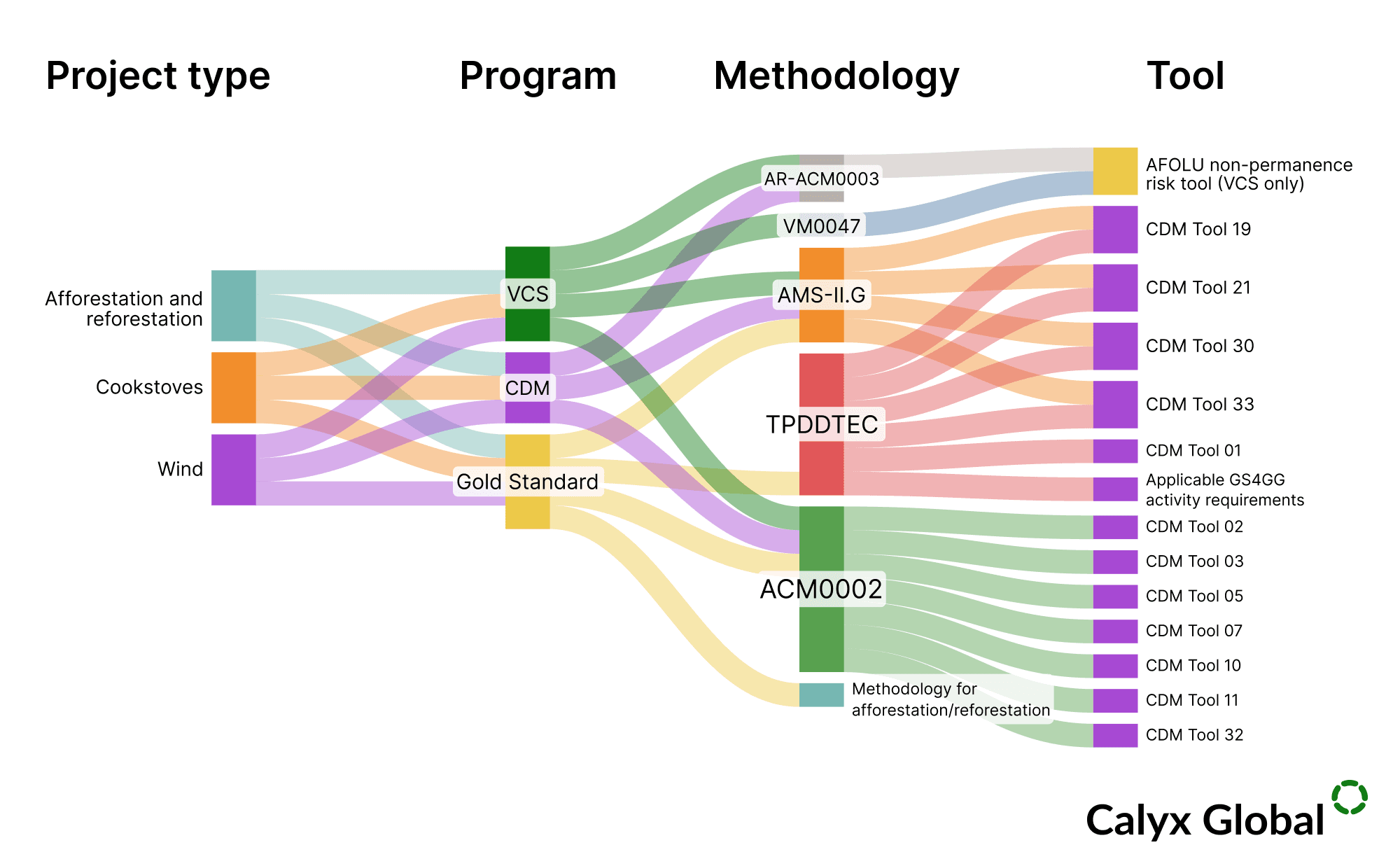

Each project involves multiple layers:

- A project type (e.g., landfill gas, improved forest management)

- A carbon standard or registry (e.g., Verra, Gold Standard)

- A selected methodology (often with multiple options)

- And sometimes, a combination of tools that add to the methodology’s provisions

The result is a complex web of documentation and decision points. Even within the same project type, different combinations can lead to vastly different rules, assumptions and integrity risks.

Visualizing this landscape looks more like a flowchart than a checklist, and most investors don’t have the in-house expertise or time to parse it.

This complexity is why assessing methodology application is so difficult. It’s not as simple as reading through the documentation for a single methodology. You must have a baseline understanding of where to focus, what trade-offs matter, and how to connect those risks to a project’s specific claims.

Without expert support, many investors are left making decisions based on labels rather than substance.

Practical advice for investors

If you’re investing in carbon projects, you don’t need to become an expert in each of the 100+ methodologies actively in use today. But you do need to ask the right questions, and know where to focus your attention.

Here are three places to start:

1. Seek transparency

Look for evidence that the project developer has clearly explained their decisions in key areas of discretion. Is sufficient justification for additionality provided? Are baseline assumptions justified with credible data? Are monitoring plans clearly defined and appropriate for the project’s context? Transparency helps reveal whether choices were made thoughtfully or opportunistically.

2. Look for conservative application

Methodologies set minimum thresholds, not optimal ones. Projects that go beyond what’s required, using lower default values, applying stricter permanence buffers or accounting for uncertainty can signal a stronger commitment to integrity. Where there are flexibilities in the methodology, an investor or buyer can ask about why certain choices were made.

3. Engage experts

Given the complexity of methodologies and the nuanced risks embedded in them, outside expertise can make the difference between a well-informed decision and a costly mistake. Whether through technical advisors or structured diligence tools, investors shouldn’t hesitate to seek support.

These steps won’t eliminate uncertainty. They can, though, help investors move from gut feel to informed confidence, while signaling to the market that quality matters.

Why this matters now

Methodologies are under more scrutiny than ever, with initiatives like the ICVCM and discussions around Article 6 of the Paris Agreement pushing for greater integrity and transparency. That’s a welcome shift. Pricing is also starting to reflect quality. It also means investors need to raise their own bar to ensure they get expected returns.

Ratings, tighter buyer expectations and reputational scrutiny are creating new incentives for developers to avoid “stretching methodologies to the allowable limit.” Still, project-by-project variation remains high. A methodology label tells you something, but not nearly enough. Understanding how that methodology was applied, and where its inherent risks lie, is what separates smart investors from exposed ones.

At Calyx Global, we’ve seen the difference it makes when investors ask the right questions early. It leads to stronger portfolios, better market signals and ultimately, a more credible VCM.

Investors committed to high-quality outcomes have two choices:

1) Spend time and resources building their understanding of an incredibly complex methodology landscape, or

2) Partner with those who already have.

To learn more about how Calyx Global can help, request a demo of our carbon credit ratings and insights platform. Or access over 950 tiered GHG ratings, free.

Keep up with carbon market trends

Get the monthly newsletter and stay in the loop.

Trusted By