3 Takeaways: What COP30 means for carbon markets

November 24, 2025 - Commentary

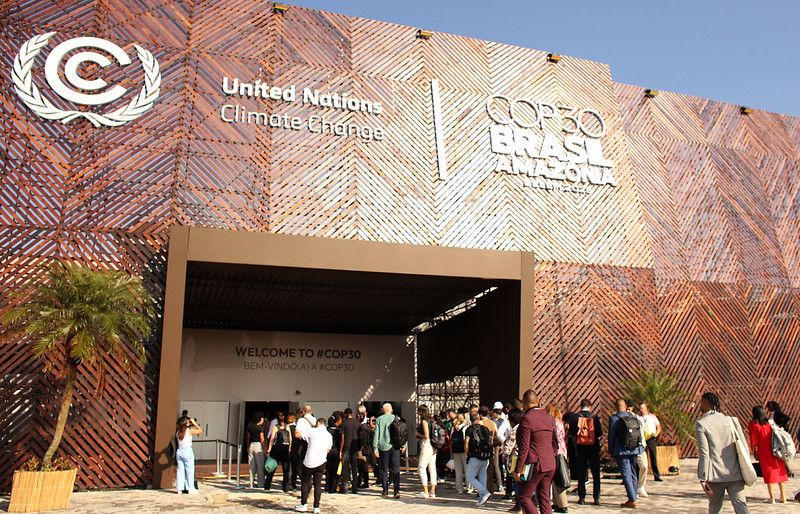

The annual United Nations Climate Conference, COP30, just wrapped up in Brazil. This was the first conference since countries agreed on a framework for the first UN-regulated global carbon market (known as “Article 6” of the Paris Agreement) last year at COP29 in Baku, after nearly a decade of negotiation.

Calyx Global was tracking negotiations and announcements at COP from both up close and afar. Here are some of the top trends and takeaways from the last two weeks:

Governments are starting to engage in carbon markets…

Sometimes what’s interesting happens outside the formal meetings. On the margins of COP30, host country Brazil launched an initiative to strengthen cooperation on carbon markets, with nearly 20 countries signing on over the course of COP. Meanwhile, several international trade organizations and countries including the UK, Kenya, and Singapore announced an effort to boost corporate demand for high-integrity carbon credits, with 11 countries joining during COP.

Takeaway: Regulated markets may dominate the future. Governments (with a notable exception to the United States) are increasingly engaging in carbon markets, wanting them to work efficiently and effectively.

…but haggled over minimum credit quality under Article 6.

COP30 was full of robust debate about Article 6, the section of the Paris Agreement that enables a mechanism for countries to trade carbon credits to meet their national climate targets. In particular, under Article 6.4 (the centralized trading mechanism), there was extensive debate over a proposed rule to revise the baseline standard for carbon projects to be increasingly stringent over several years. There was also heavy lobbying against such a rule by supporters of nature-based crediting—worried it would adversely affect nature-based projects—as well as an effort to re-open guidance around permanence to enable a smoother pathway for nature-based crediting. Furthermore, some pushed for Article 6.2 (the decentralized, bilateral trading mechanism) to be more rigorous, with a clear enforcement mechanism.

Ultimately, no significant changes were made to Article 6 rules. The existing, stringent guidance on permanence (to achieve “negligible” reversal risk) stood, in spite of a robust campaign by supporters of nature-based crediting.

Takeaway: Article 6.4 may set a new benchmark for carbon credit quality. These debates matter because what the COP ultimately considers “good enough” for international emissions trading will have an impact across all markets. Not least because Article 6 has the imprimatur of governments.

Can the PACM restore confidence in carbon markets?

Carbon markets have taken a hit since investigative journalists paid more attention to them in recent years, uncovering their flaws. In the wake of these exposés, the voluntary market in particular started to falter. In order for markets to work, they must be underpinned by confidence and trust.

The Integrity Council for the Voluntary Carbon Market (ICVCM) was developed to shore up carbon markets. It is two steps ahead of Article 6, and is also setting a benchmark for credit quality. In many ways, it has already helped to improve the quality of the voluntary carbon market (VCM). Our data shows that the VCM is improving—but too slowly. There is still a yawning confidence gap.

If one were to read tea leaves, it appears that Article 6.4 may be even more stringent than the ICVCM. The guidance on permanence appears more conservative than the ICVCM’s 40-year durability requirement. The Article 6 Supervisory Body recently approved a landfill gas methodology that is stricter than the ICVCM’s CCP labeling for landfill projects.

Takeaway: Article 6 can support renewed confidence (sorely lacking) in carbon markets. Corporates who have the ability to support mitigation beyond their value chain need to see this confidence before jumping in.

We’ll be tracking if and how momentum from Article 6.4, often called the Paris Agreement Crediting Mechanism (PACM) evolves and influences the market. Ideally, the ongoing work under Article 6 will help accelerate the quality of carbon markets, spurring more corporate action – leading to better outcomes for our planet.

About the author: Calyx Global leads the market with over 1,000 GHG and 500 SDG ratings that assess the quality of carbon credits, including their climate integrity, sustainable development contributions, and social and environmental risks. To preserve independence, Calyx Global’s ratings are not financed by the entities whose projects we assess.

Keep up with carbon market trends

Get the monthly newsletter and stay in the loop.

Trusted By