The Guardian (Again): Are they right or wrong?

October 9, 2025 - Research

This week, the Guardian released another scathing article on carbon offsets. As we’ve done before, we are here to set the record straight.

In 2023, the Guardian wrote an article suggesting that the majority of offsets are “likely junk.” We wrote a response looking carefully at the claims made in the article and providing our view. This time, the Guardian posted that “Carbon offsets fail to cut global heating due to ‘intractable’ systemic problems”. Are they correct?

First, let’s start with areas where we agree:

#1 - The market’s overall quality is poor

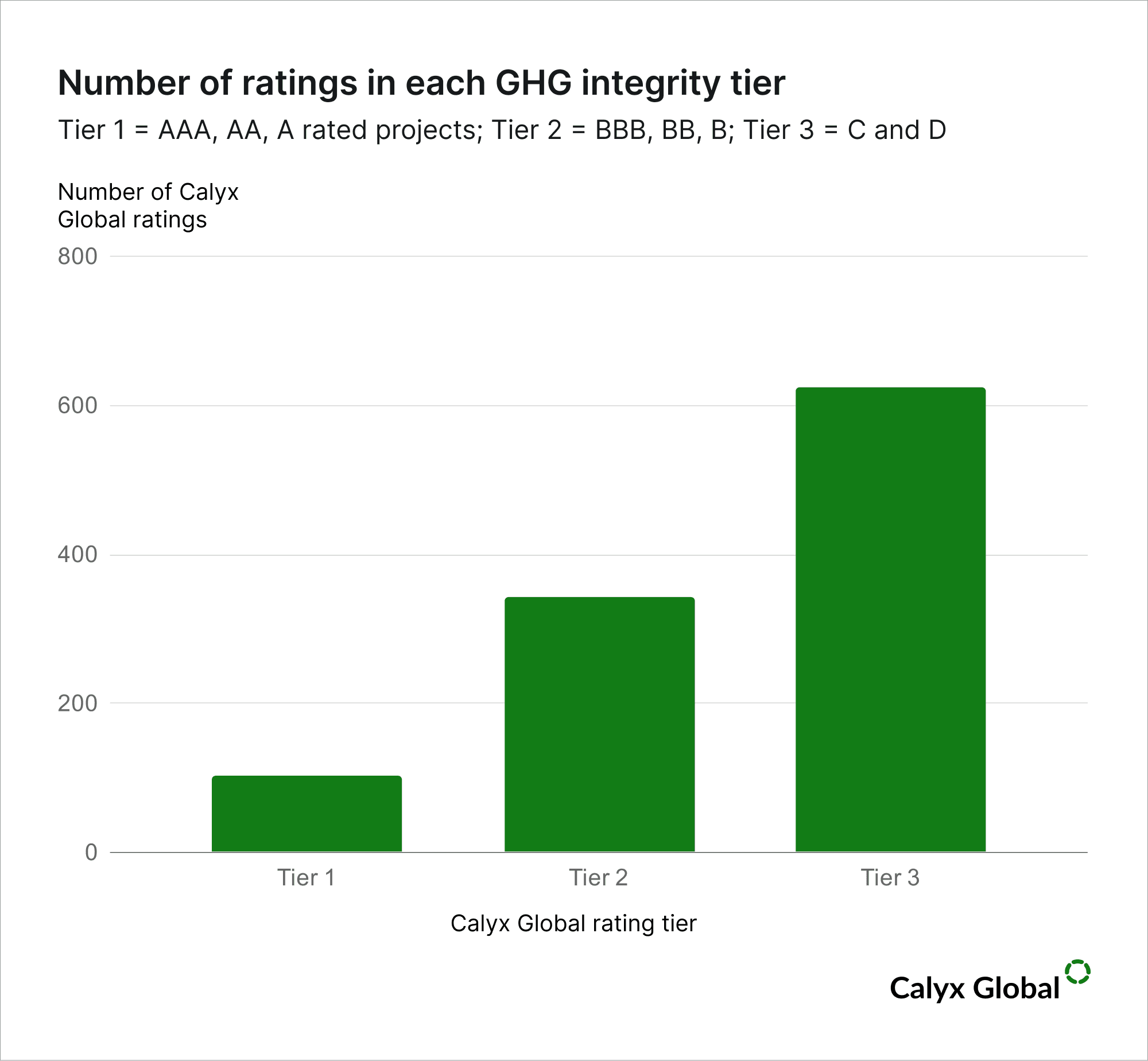

The article states that “...voluntary carbon markets have long been plagued by ‘junk offsets’ that overstate their impact.” Sadly, we agree. We have over 1,000 ratings and, among these, only around 10% fall into our Tier 1 category.

#2 - Some project types can deliver higher quality

Here we also agree. “We don’t want to throw the baby out with the bathwater,” said Stephen Lezak, one of the authors of the underlying study that initiated the Guardian article. “There are a couple of important domains where it is important to highlight success, or the potential for it.” In particular, he mentions cookstoves and landfill gas as project types that currently suffer from over-crediting but could be remedied.

We would agree with both the sentiment about babies and bathwater, and also that cookstoves and landfill gas are credit types whose quality can be relatively easily improved. Furthermore, Calyx Global has found a number of other project types that can generate high-quality credits. Many are currently in the category commonly referred to as “superpollutants” – you can read more about these in a recent report we co-authored with the Carbon Containment Lab.

#3 - There are systemic factors in the market that need to be addressed

The article interviewed an author of a similar study, Benedict Probst, who warned of “other systemic factors such as the small constituency advocating for high-quality projects, conflicts of interest when drafting standards and “chronically understaffed” regulators.”

We would agree with this comment. In fact, our co-founder wrote a blog about some of the systemic issues that have created “headwinds” for the VCM. Chief among them are conflicts of interest that have long existed in the market. In fact, the reason why Calyx Global was founded was to insert into the VCM ecosystem an entity whose purpose would be to bring balance – and a different set of business interests.

We also found a few issues that we do not agree with:

#1 - Assessing the past to predict the future.

It is often said that “history repeats itself.” The article quotes the author of the study, Stephen Lezak, who says, “We have assessed 25 years of evidence and almost everything up until this point has failed.” This is not a fair statement. The pre-2020 market is very different from the post-2021 market, so a comparison is short-sighted.

For around two decades the VCM traded less than 50 million credits per year. It was small and inconsequential. Around 2019, the market began to grow, reaching a high in 2021 of over 350 million credits issued. Suddenly the VCM became… consequential. With the growth of the market came increased scrutiny from a number of actors (including academia and the media). This is healthy for the market and spurred the development of a number of new institutions whose goal was to strengthen and improve the market.

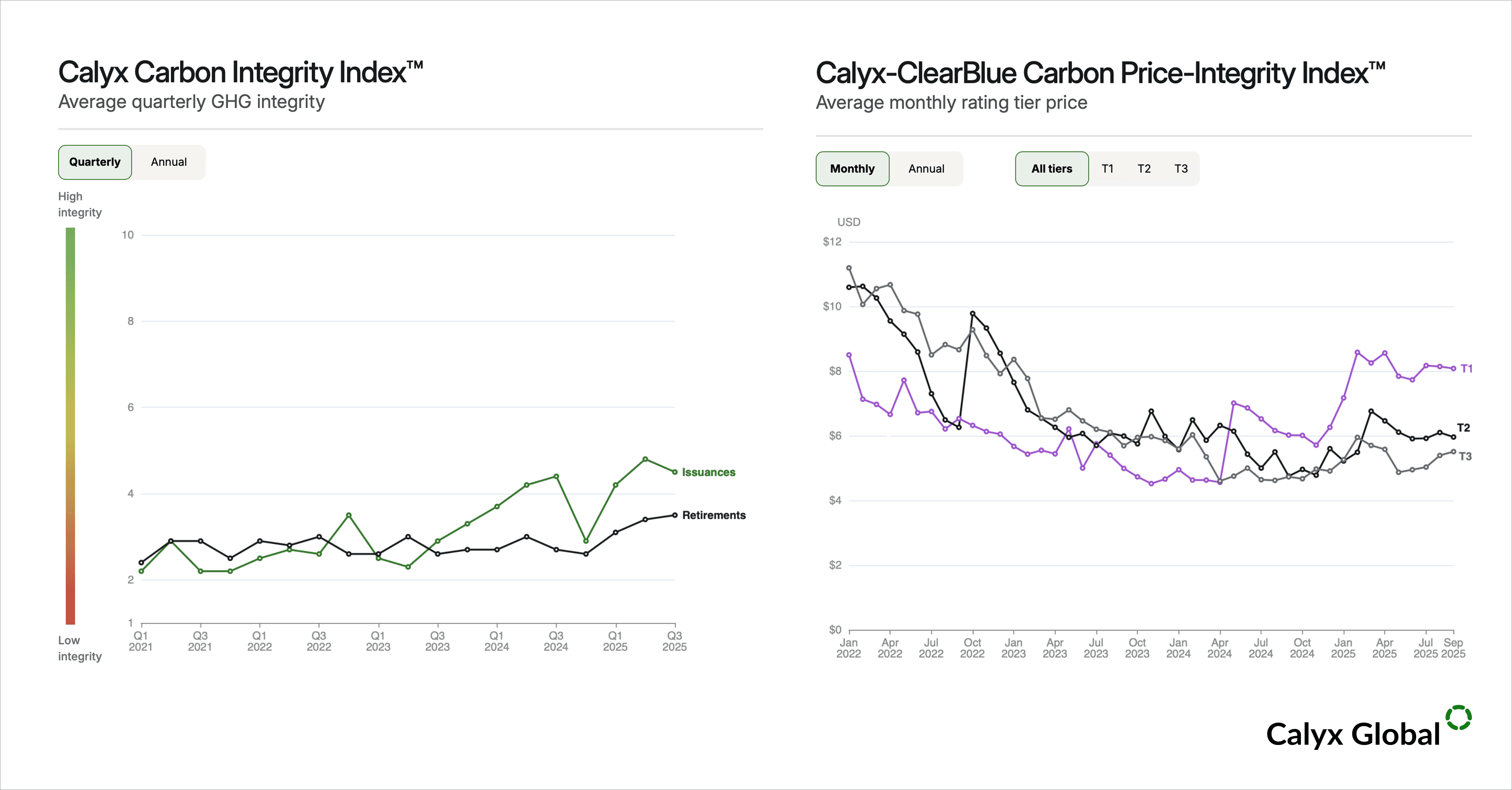

The result? The market is improving. The Calyx Carbon Integrity Index tracks the overall quality in the market. While the overall quality remains far too low (below 5 out of 10), we not only see an overall trend towards improvement but a new “price discovery” where higher quality is gaining higher prices.

Source: https://calyxglobal.com/carbon-indices/

#2 - Misunderstanding the nature of carbon credits and buyer intent

The article couches carbon credits in this way: “Carbon offsets are a tool to cut emissions efficiently by crediting rich polluters for financing cheap climate action abroad while pumping out the same amount of planet-heating gas at home.” The underlying study makes a similar point, saying, “...major buyers do not demand a quality product.”

We work with many of the largest carbon credit buyers in the market today. Our experience interacting with these companies does not support either premise.

First, many companies are not using offsets as a “get out of jail free” card. Most work hard on reducing their own emissions and buy credits to offset hard-to-abate emissions. In addition, we see how these buyers work hard to find – or even invest in – high-quality offsets. Whether it’s altruism (a CEO who cares about climate change, such as Marc Benioff or Bill Gates) or simply a desire to protect their brand and reputation, our experience is that many buyers demand high-integrity credits. If they didn’t, they would not pay Calyx Global to support this hunt for high quality.

#3 - Suggesting the market should only focus on durable removals

The review authors recommend “urgently phasing out offsets that [do] not actively suck CO2 from the atmosphere” and shifting offset markets to focus on high-quality carbon dioxide removal and storage. This is a concept at the heart of the controversy between many market actors and the Science Based Targets Initiative (SBTi), which has similarly argued for only durable removals and only once a target comes due (e.g., 2040 or 2050).

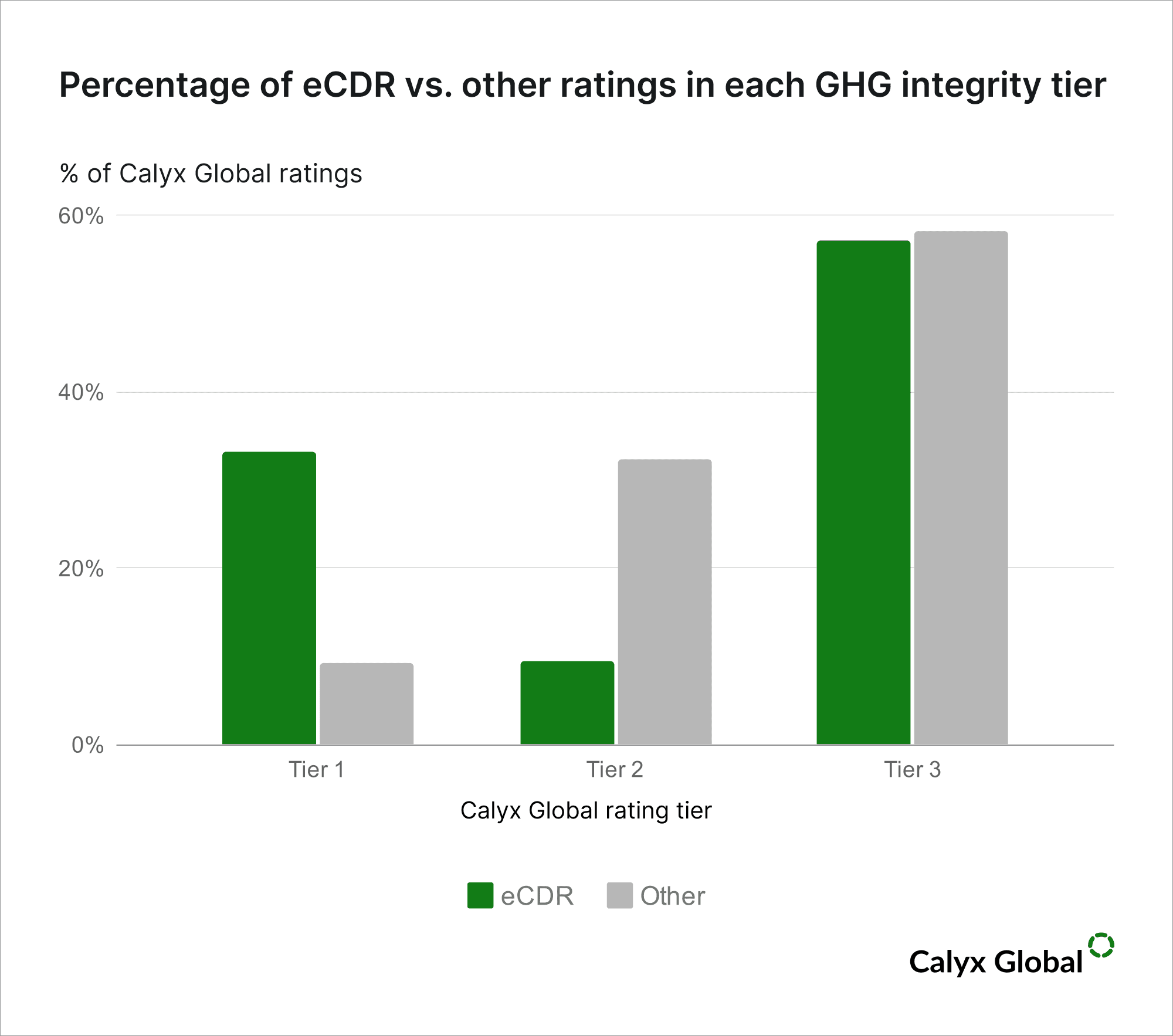

Here, we simply flag a few points: First, engineered carbon dioxide removals are not always the highest quality in the market. Our analysis of many carbon projects suggests that eCDR suffers from quality issues, just like many other credit types. We recently wrote a paper on one of the most talked-about eCDR credit types: Direct Air Capture, and why we find that there is over-crediting occurring in these projects.

Secondly, we need to “turn off the tap.” Focusing only on eCDR would not achieve the Paris Agreement goal of avoiding dangerous climate change. Neither would it help us avoid tipping points that are fast approaching. The fact is: We need it all – avoiding emissions today and also investing in technologies that will help us suck CO2 out of the atmosphere at scale tomorrow.

“Research has documented that high-integrity offsets are possible at the project level with certain rigorous approaches,” write the study’s authors. Based on our data and analysis of over 1,000 ratings, we very much agree. Let’s rapidly expand the “small constituency advocating for high-quality projects” and ensure we continue to bend the quality curve in the right direction.

Keep up with carbon market trends

Get the monthly newsletter and stay in the loop.

Trusted By